I am going to venture away from some of my more recent posts on specific deal considerations and focus this post more on valuation and buyer/seller value expectations. A common question that new (and even seasoned investors) ask is why would two companies in the same industry, with the same general financial performance, command vastly different valuations? The answer often comes down to how much each business is likely to grow in the future.

The challenge is that a lot of successful businesses reach a point where their growth starts to slow as the company (or market) matures. In fact, the price of doing a great job carving out a unique niche is that the specialty that made you successful can start to hold you back. As a simple example, if you make the world’s greatest $4,000 bread maker, you may have a successful, profitable business until you run out of people willing to spend $4,000 to make their own bread.

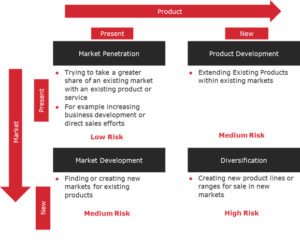

Demonstrating how your business is likely to grow in the future is one of the keys to driving a premium price for your company when it comes time to sell. To brainstorm how to grow beyond the niche that got you started, consider the Ansoff Matrix. It was first published in the Harvard Business Review in 1957 but remains a helpful framework for business owners today.

Sometimes called the Product/Market Expansion Grid, the Ansoff Matrix shows four ways that businesses can grow, and it can help you think through the risks associated with each option.

Imagine a square divided into four quadrants representing your four growth choices, which include selling…

The choices above are presented from least to most risky. In a smaller business, with few dollars to gamble, focusing your attention on the first two options will give you the lowest risk options for growth.

Market Penetration: Selling existing products to existing customers

It’s natural to feel like you’re being greedy when you go back to the same customers for more of their dollars, but the opposite can often be true. Your best customers are usually the ones who know and like you the most and are often pleased to find out that you – someone they trust – are offering something they need.

A simple example is Robert, a hardware store owner in Drayton Valley, Alberta who came to understand the Ansoff Matrix. Robert earns a 150% mark up on cutting keys but his cutter was hidden in a corner of the store where nobody could see it. As a result, he didn’t cut many keys. One day, Robert decided to move the key cutter and position it directly beside the cash register so everyone paying for his or her hardware could see the machine. Customers started seeing the cutter and realized – often to their pleasant surprise – that Greg cut keys.

Not surprisingly, Robert started selling a lot more keys to his loyal customers. The key cutter didn’t woo many new customers, but it did increase his overall revenue per customer.

If you want to sell more of your existing products to your existing customers, draw up a simple chart of your products and services. Don’t be afraid to dust off those old products that you haven’t paid much attention to lately. List your best customers’ names down one side of the paper and your products across the top. Then cross-reference your customer list with your product list to identify opportunities to sell your best customers more of your existing products.

Product Development: New Products to Existing Customers

Another approach to growth is to sell new products to existing customers. For example, Michael is a BWM dealership owner in Southern Alberta, whose typical customer is a family patriarch in his forties. When he felt like he had saturated the market for well-heeled forty-something men in his franchise area, he thought about what other products he could sell his existing customers. But instead of defining his customer as the forty-something man, he decided to think of his customer as the financially successful family and his market as their driveway.

Instead of trying to sell more BMWs into a market of diminishing returns, Michael bought a Honda dealership so he could sell minivans to the spouses of his BMW buyers. He then realized that a lot of his customers had kids in their teens so he bought a Hyundai dealership to sell the family a third, inexpensive car.

Once your business is established – there are many strategies you can take. You can turn into the “cash cow” business that provides ownership with a steady and reliable income or it can be a launching point for other businesses, but that requires additional management time and capital. That strategy is up to you, but the point of this post was to drive home the point that in order to drive up the value of your business, you need to be able to demonstrate how you can grow as that’s what buyers will pay a premium for, and the least risky strategy is to figure out what else you could sell to your existing customers.